Some Known Incorrect Statements About Stonewell Bookkeeping

An Unbiased View of Stonewell Bookkeeping

Table of ContentsNot known Factual Statements About Stonewell Bookkeeping The Only Guide for Stonewell BookkeepingStonewell Bookkeeping - QuestionsAn Unbiased View of Stonewell BookkeepingThe Definitive Guide for Stonewell Bookkeeping

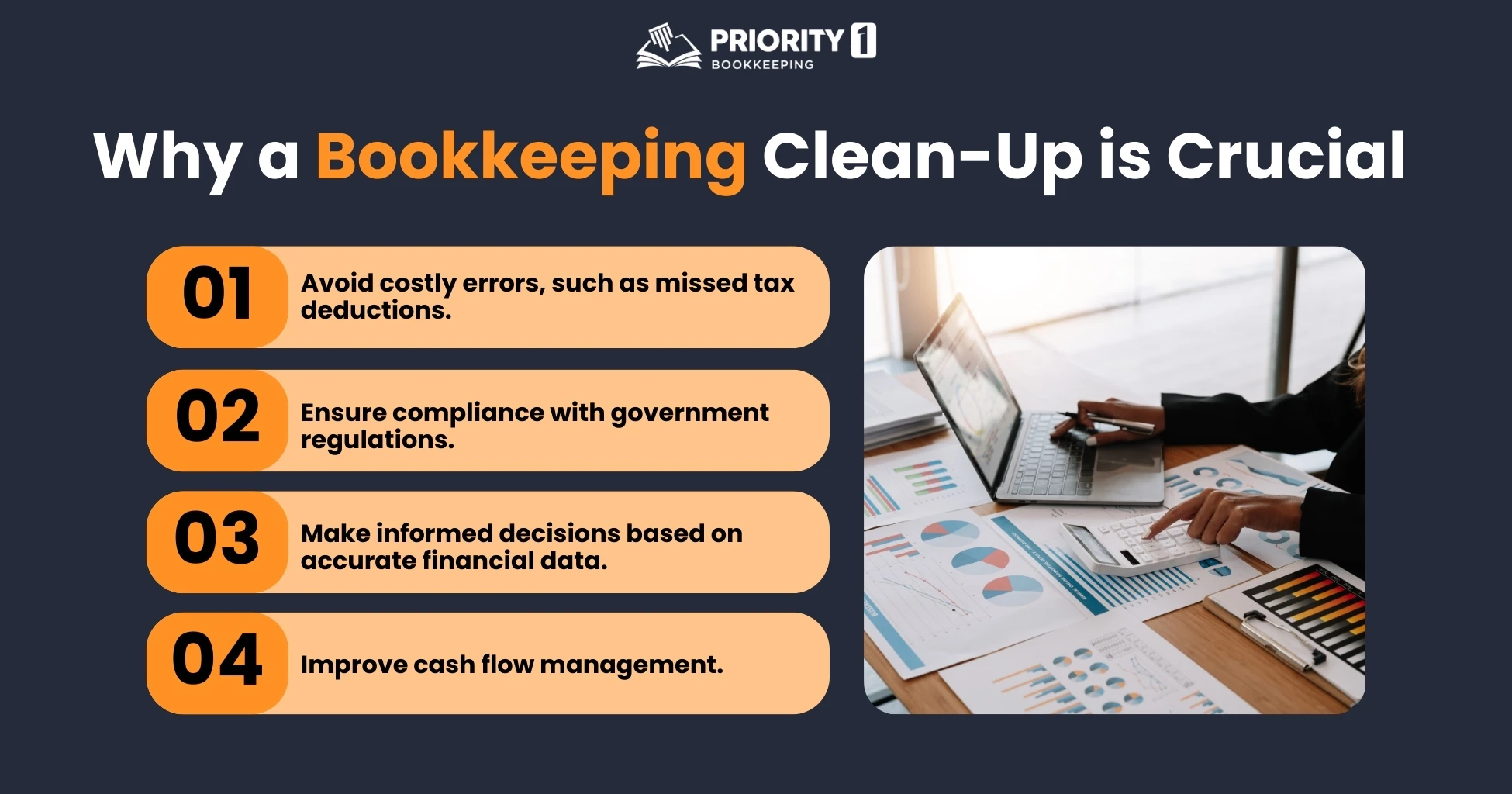

Rather of going with a filing cabinet of various records, billings, and receipts, you can offer in-depth documents to your accounting professional. After using your audit to file your taxes, the IRS may pick to perform an audit.

That funding can come in the type of proprietor's equity, grants, service loans, and investors. Investors need to have an excellent concept of your company prior to investing. If you don't have audit records, capitalists can not determine the success or failing of your company. They require up-to-date, accurate info. And, that info requires to be conveniently easily accessible.

Fascination About Stonewell Bookkeeping

This is not meant as legal guidance; to find out more, please click right here..

We addressed, "well, in order to recognize just how much you require to be paying, we require to know just how much you're making. What is your net income? "Well, I have $179,000 in my account, so I guess my net income (revenues less expenditures) is $18K".

Examine This Report about Stonewell Bookkeeping

While it can be that they have $18K in the account (and even that might not hold true), your equilibrium in the bank does not always identify your profit. If someone got a grant or a car loan, those funds are not thought about earnings. And they would not work into your earnings statement in establishing your revenues.

Several points that you think are expenditures and reductions are in reality neither. An appropriate set of publications, and an outsourced bookkeeper that can appropriately classify those transactions, will certainly assist you recognize what your service is actually making. Bookkeeping is the process of recording, classifying, and arranging a firm's monetary transactions and tax obligation filings.

An effective business requires assistance from specialists. With practical objectives and an experienced accountant, you can quickly address obstacles and maintain those worries away. We're here to aid. Leichter Accounting Providers is a seasoned CPA firm with a passion for bookkeeping and dedication to our clients - Accounting (https://slides.com/hirestonewell). We commit our power to ensuring you have a solid monetary foundation for growth.

The smart Trick of Stonewell Bookkeeping That Nobody is Discussing

Exact accounting is the foundation of great financial monitoring in any organization. With excellent accounting, companies can make much better choices since clear economic documents use useful information that can direct method and increase profits.

On the other hand, strong bookkeeping makes it much easier to safeguard funding. Precise financial statements construct depend on with loan providers and financiers, enhancing your possibilities of obtaining the capital you require to expand. To maintain strong monetary health and wellness, services must on a regular basis integrate their accounts. This indicates coordinating transactions with bank statements to catch mistakes and prevent economic disparities.

They guarantee on-time settlement of expenses and quick consumer settlement of invoices. This boosts capital and helps to stay clear of late fines. A bookkeeper will certainly cross bank declarations with interior documents at the very least as soon as a month to locate mistakes or inconsistencies. Called bank settlement, this procedure ensures that the monetary documents of the business suit those of the financial institution.

They monitor existing payroll information, deduct tax obligations, and figure pay scales. Accountants produce fundamental economic records, including: Profit and Loss Declarations Shows earnings, costs, and web revenue. Annual report Lists assets, responsibilities, and equity. Capital Declarations Tracks cash motion in and out of the business (https://share.evernote.com/note/5587c683-b5c4-c2ef-a1f0-e1c7f8ace7d1). These records help service owners recognize their monetary position and make notified choices.

The Greatest Guide To Stonewell Bookkeeping

The most effective option relies on your spending plan and business demands. Some small company proprietors prefer to take care of accounting themselves utilizing software. While this is cost-efficient, it can be time-consuming and susceptible to mistakes. Devices like copyright, Xero, and FreshBooks enable local business owner to automate accounting tasks. These programs aid with invoicing, bank reconciliation, and economic reporting.